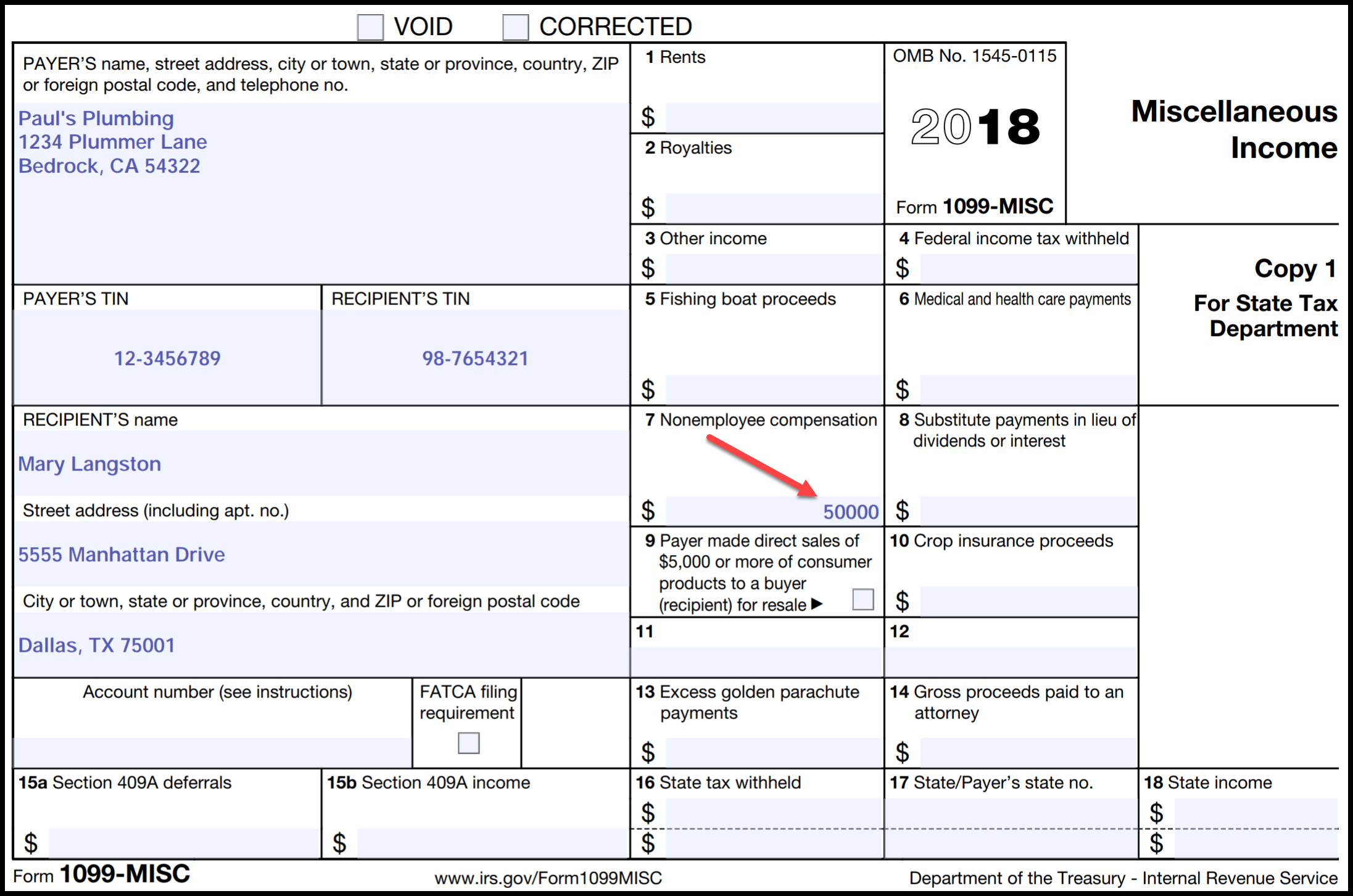

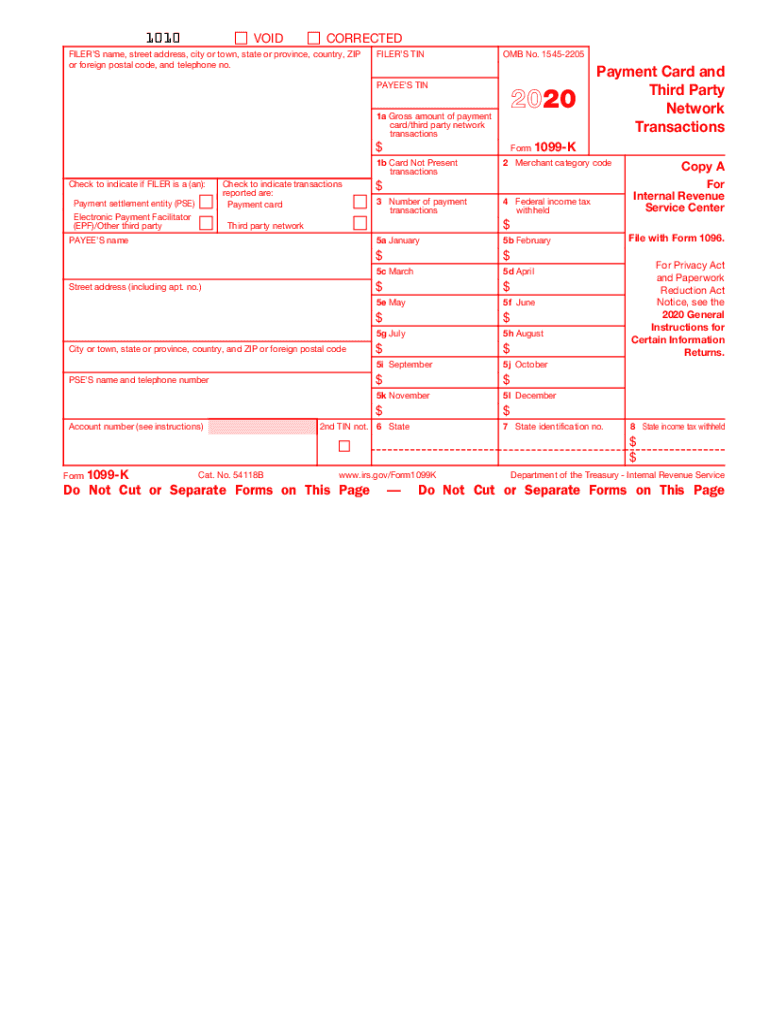

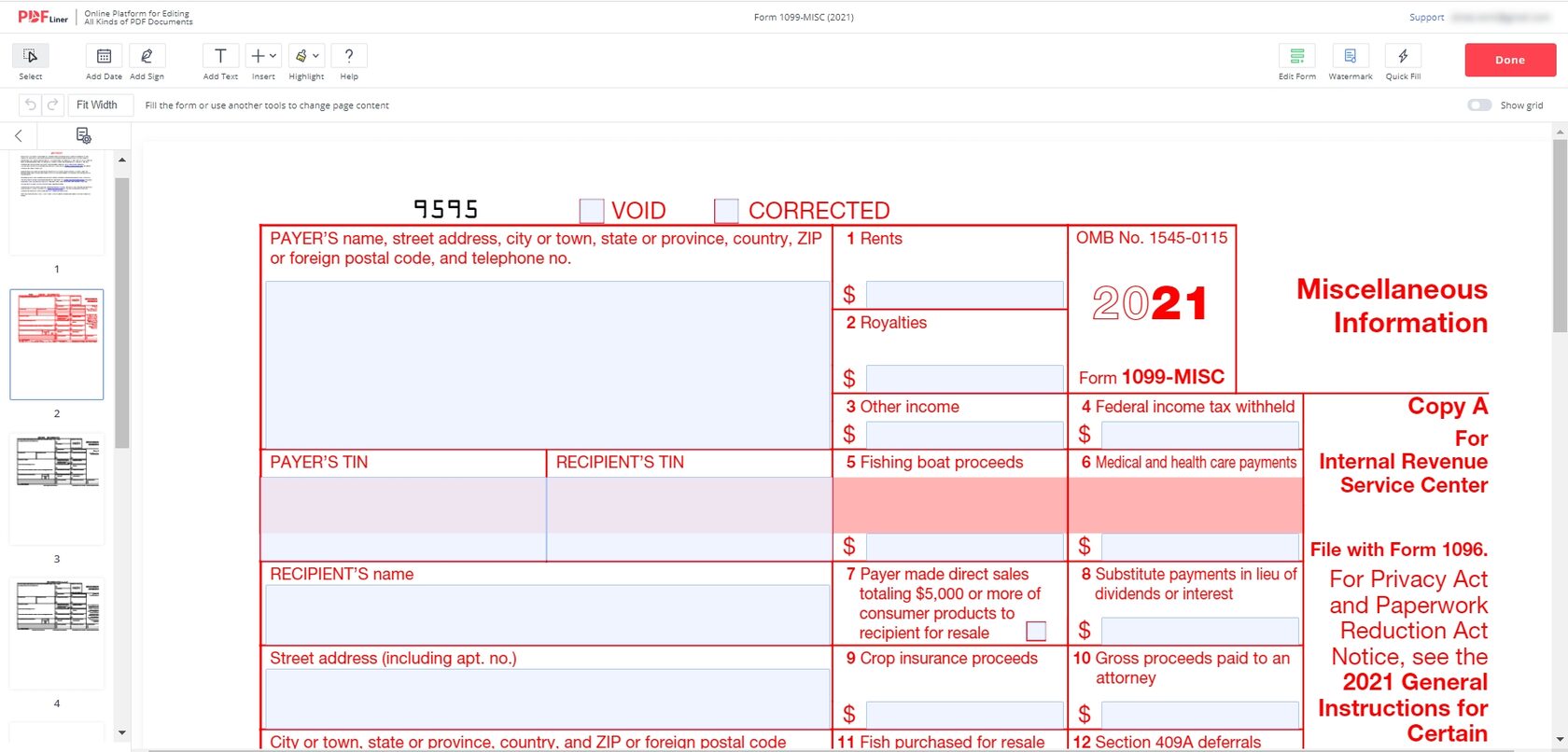

You may also have a filing requirement1099 Form Independent Contractor Pdf You must also complete form 19 and attach it to your return Fill out, sign and edit your papers in a few clicks 1099 k for If you employ independent contractors, you're required to prepare 1099s for each worker for tax purposes There is a lot of confusion regarding independent contractors The primary tax form received by an independent contractor is Form 1099MISC If you performed work for a person or business as an independent contractor, you will receive this form at the same time that employees receive W2 forms They usually arrive around the end of January following the tax year

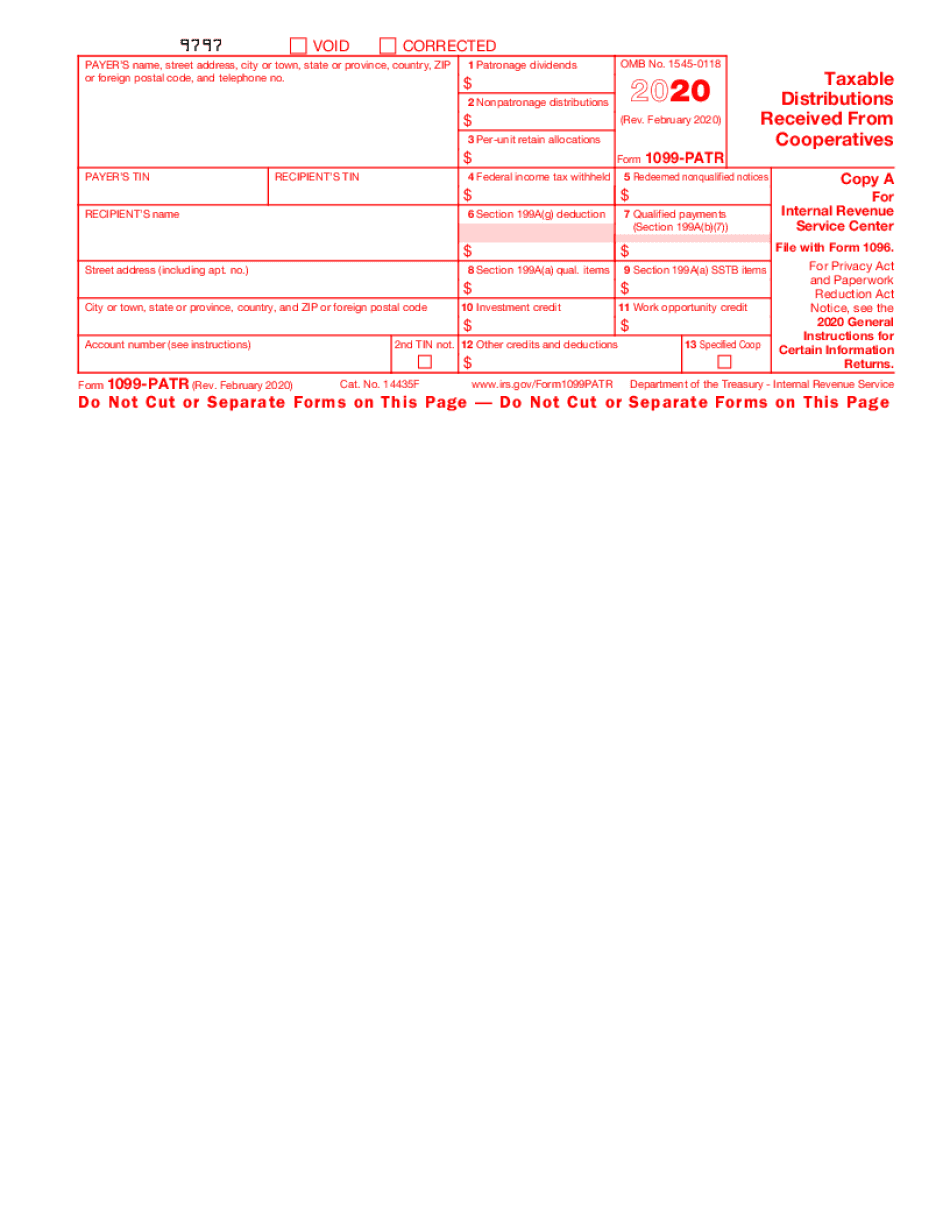

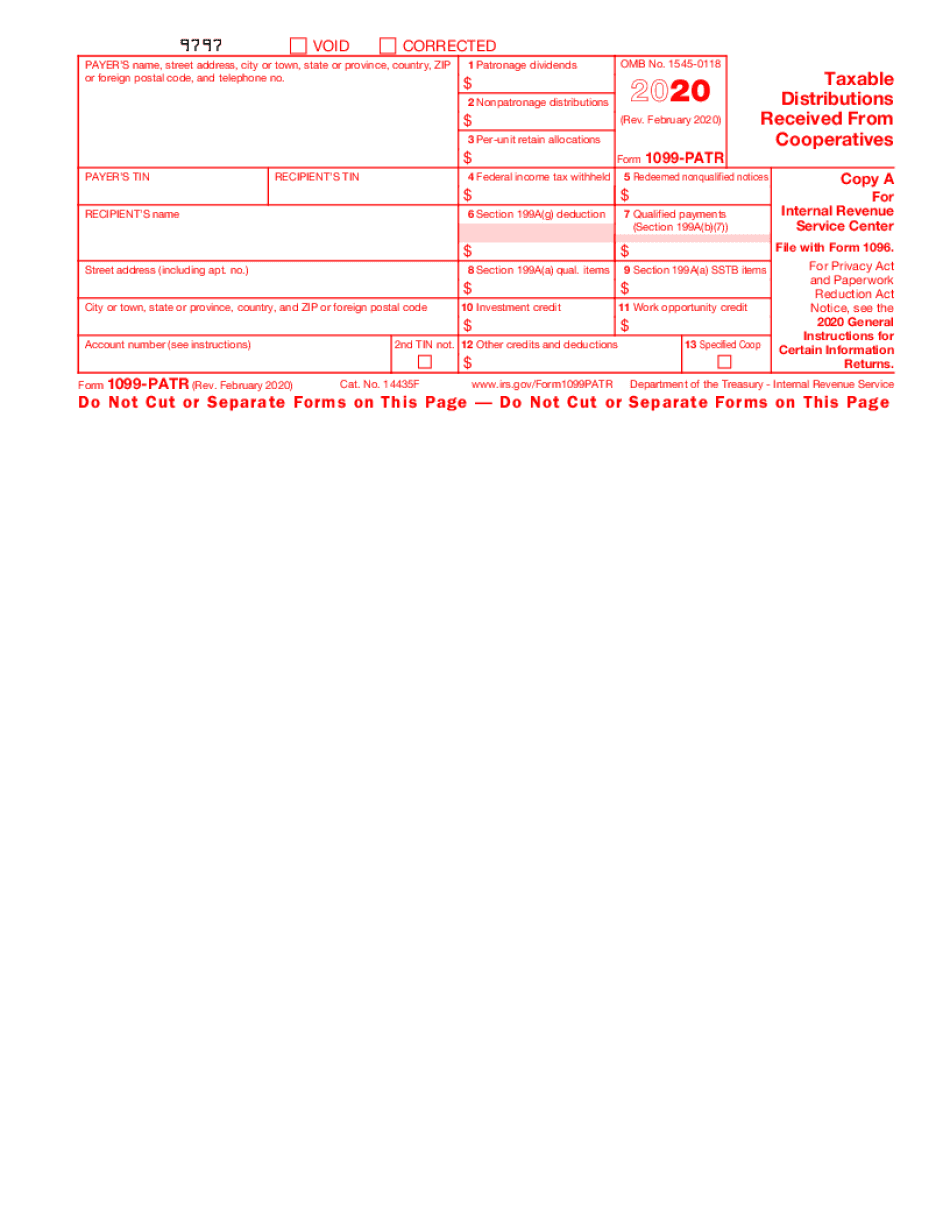

Form 1099 Patr 21 Fill Online Printable Fillable Blank Form 1099 Patr Com

Which 1099 form to use for independent contractors

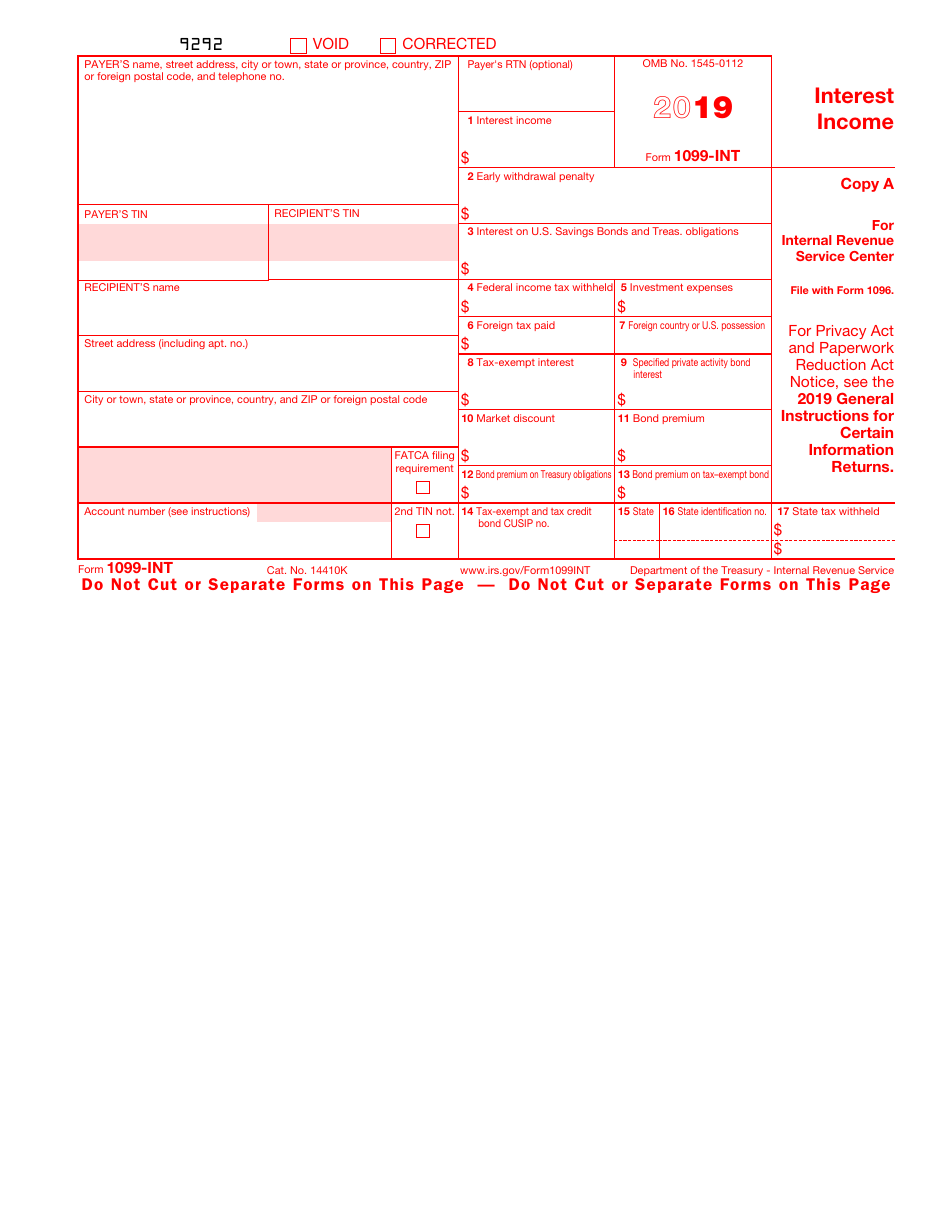

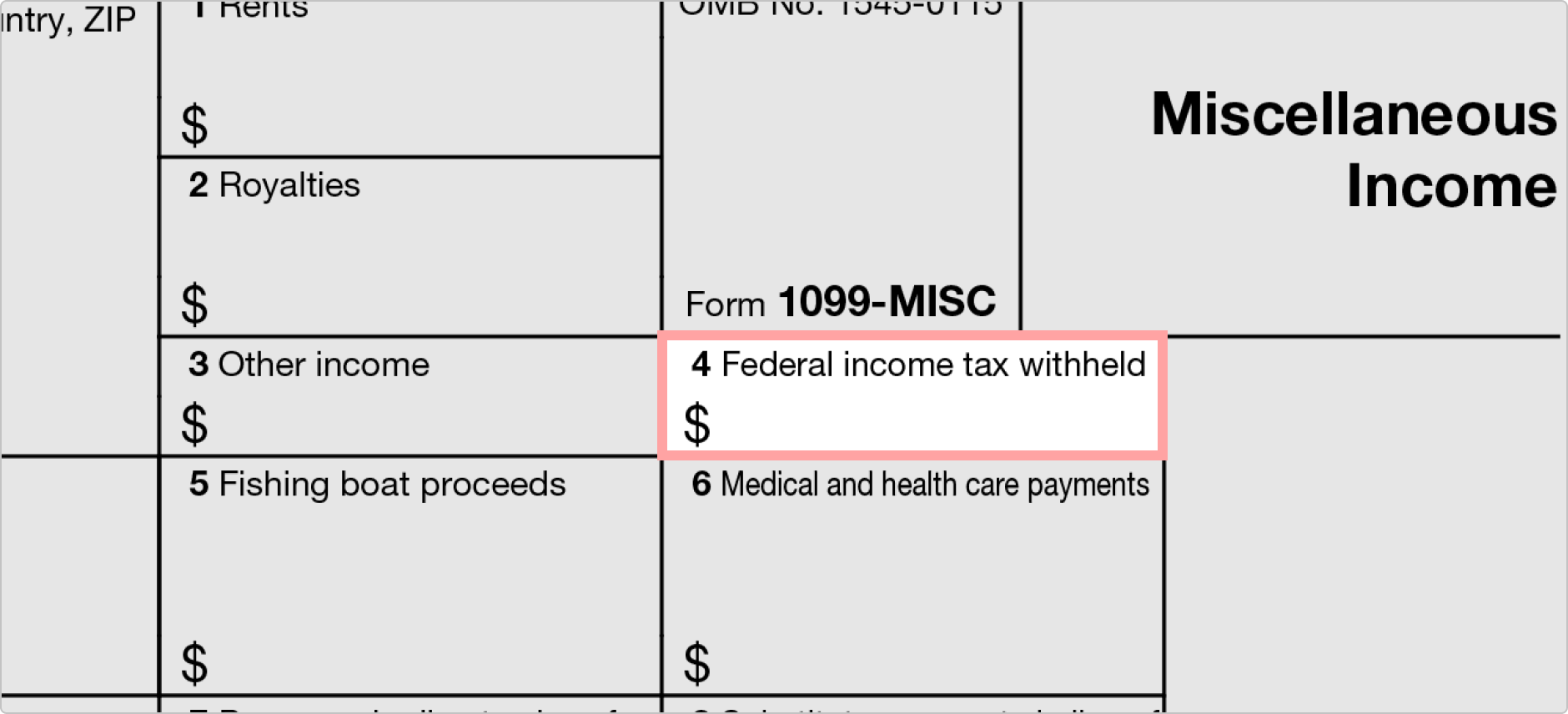

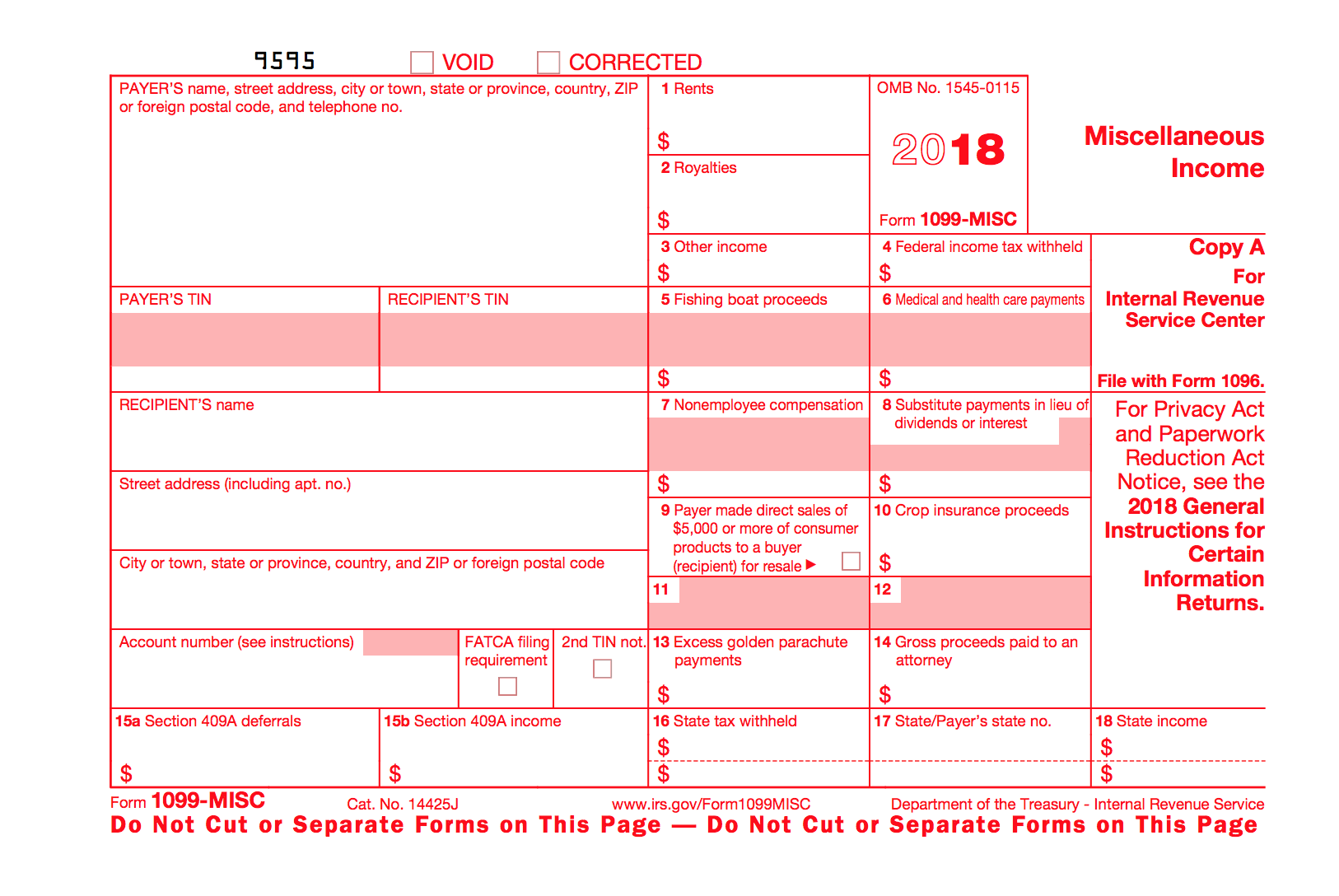

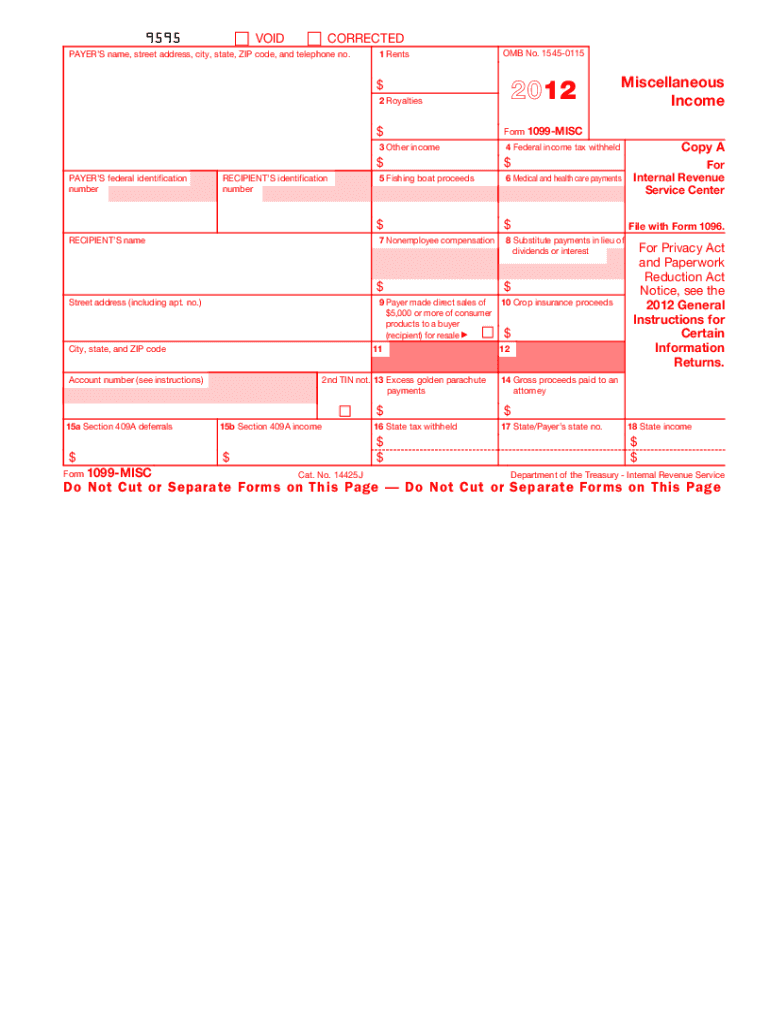

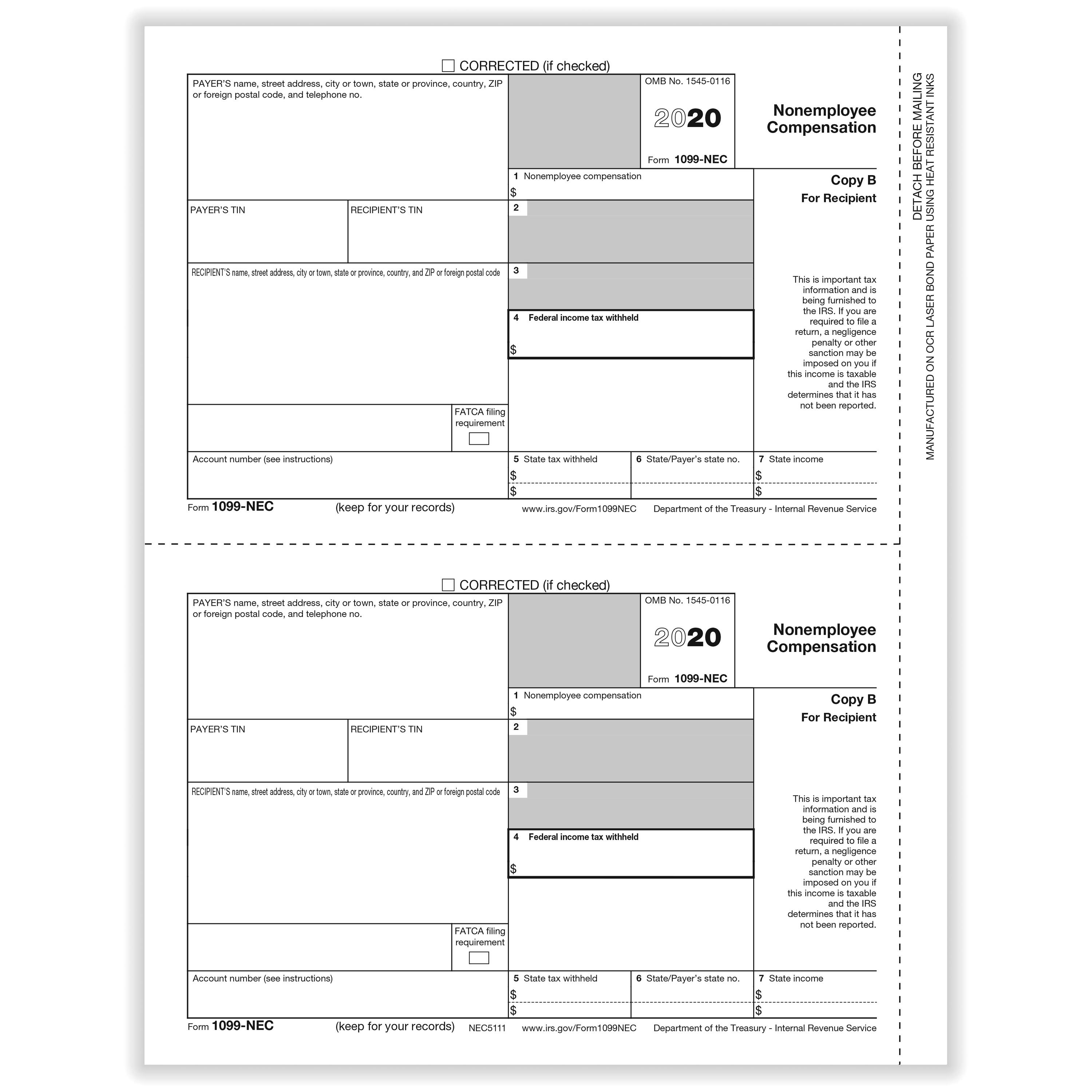

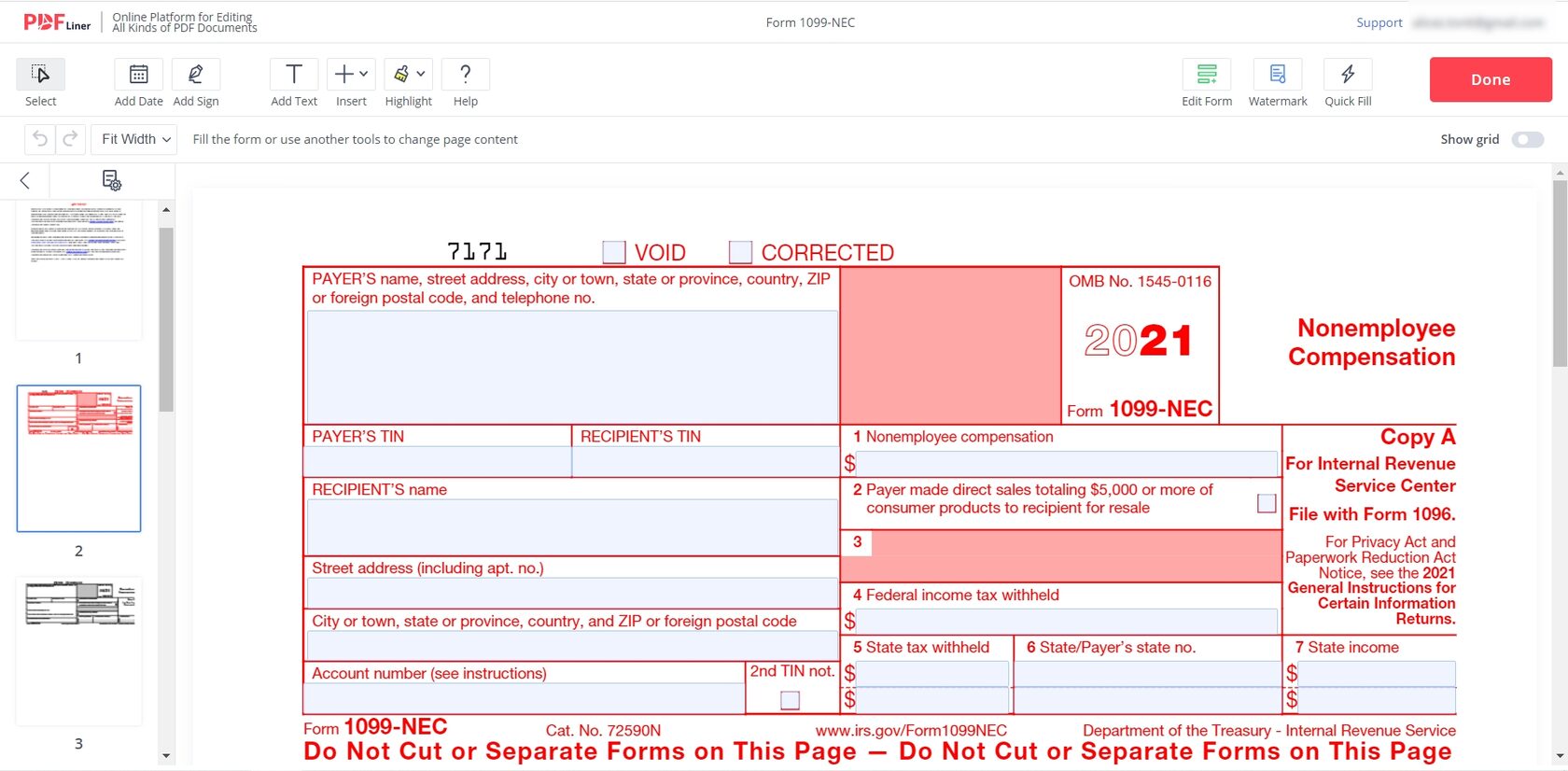

Which 1099 form to use for independent contractors-Starting with the tax year of , a 1099MISC Form is meant to be filed for every person (ie nonemployee) you have paid over $600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099MISC form is featured below A 1099NEC Form is now the appropriate form to file for compensation1099 Form Independent Contractor Pdf 1099 Misc Form Fillable Printable Download Free Instructions For more information, see pub Companies use it to report income earned by people who work as independent contractors the irs requires businesses to file a copy of the 1099 form with them and mail another copy directly to the independent contractor, so that the irs

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

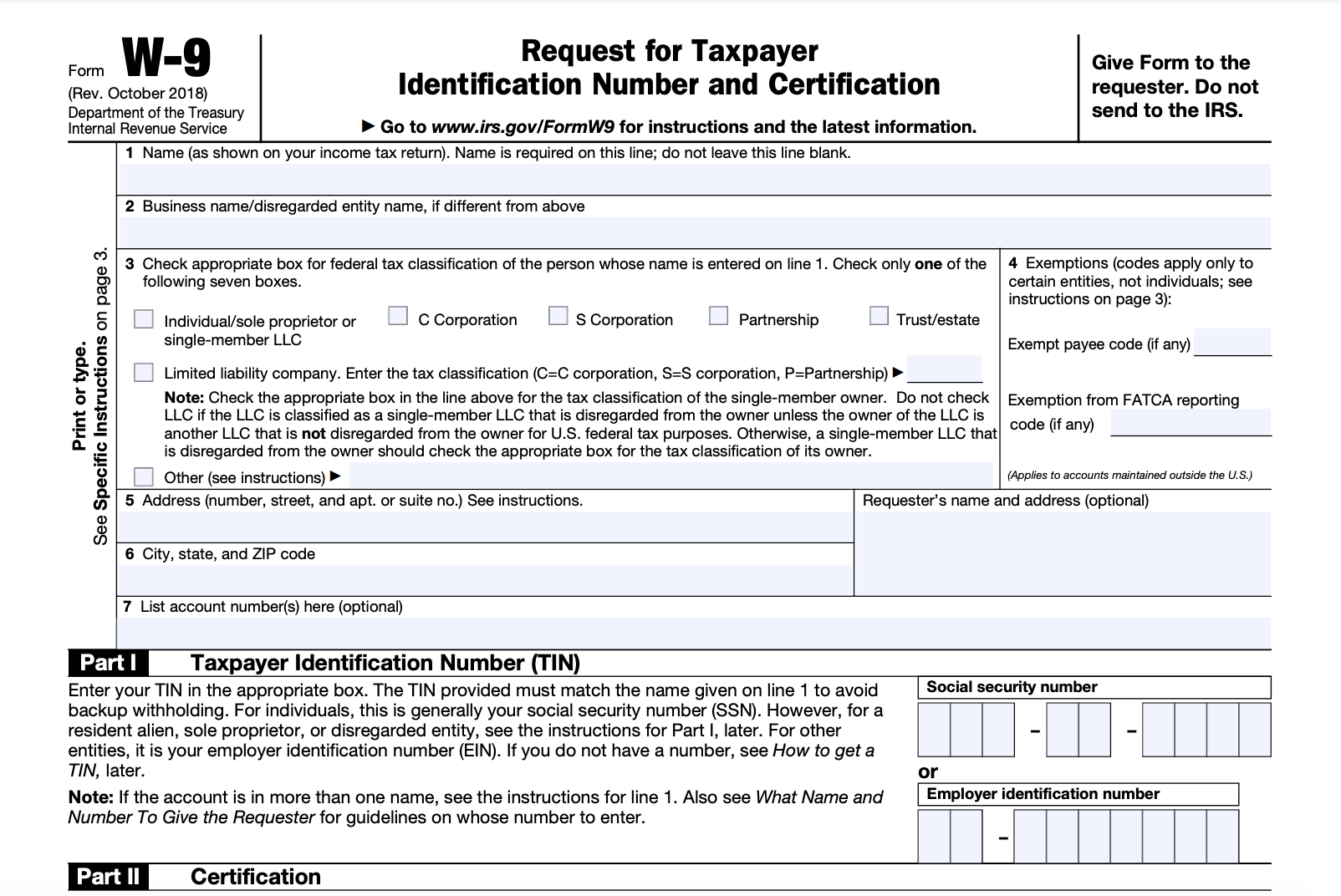

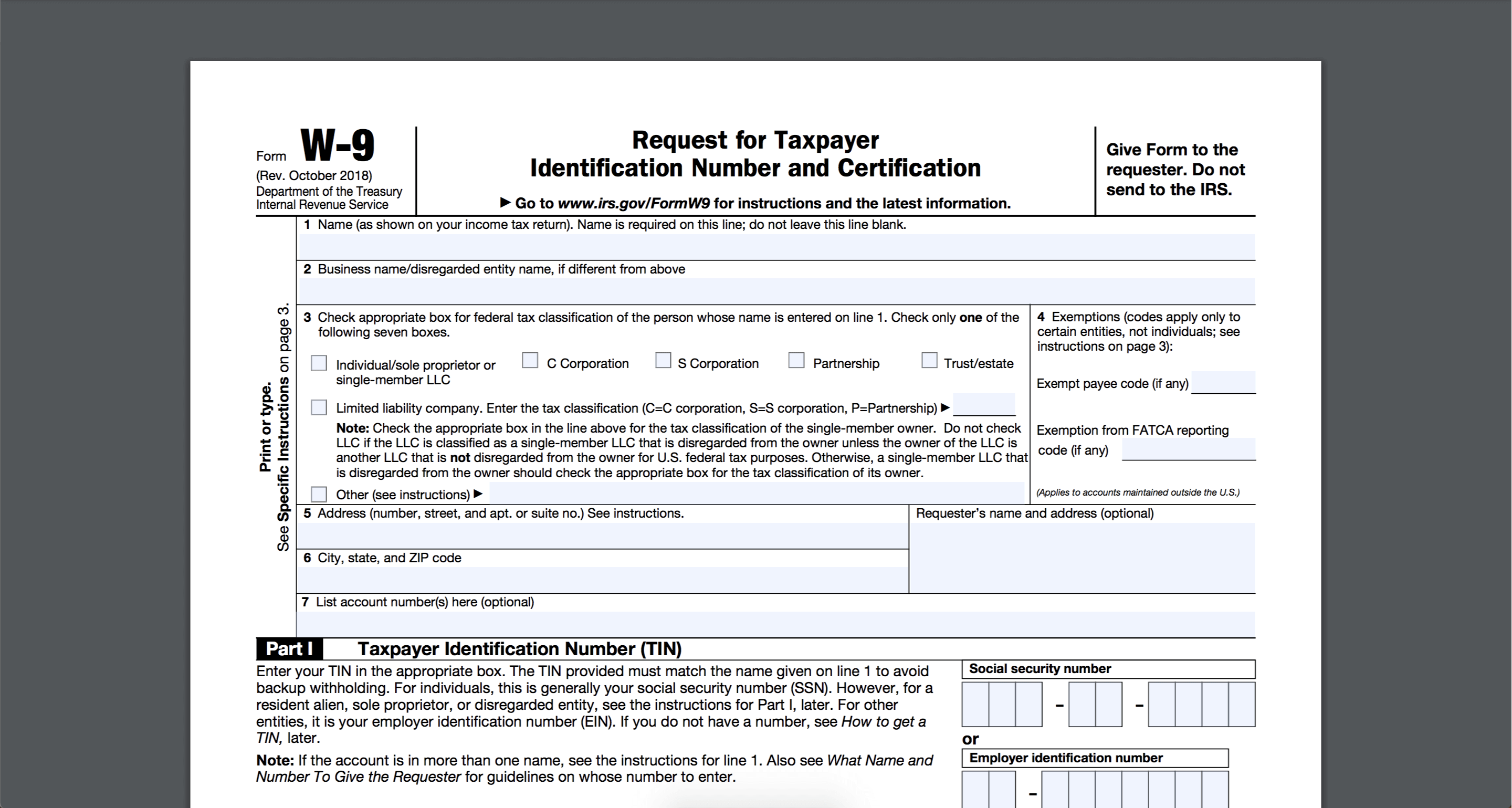

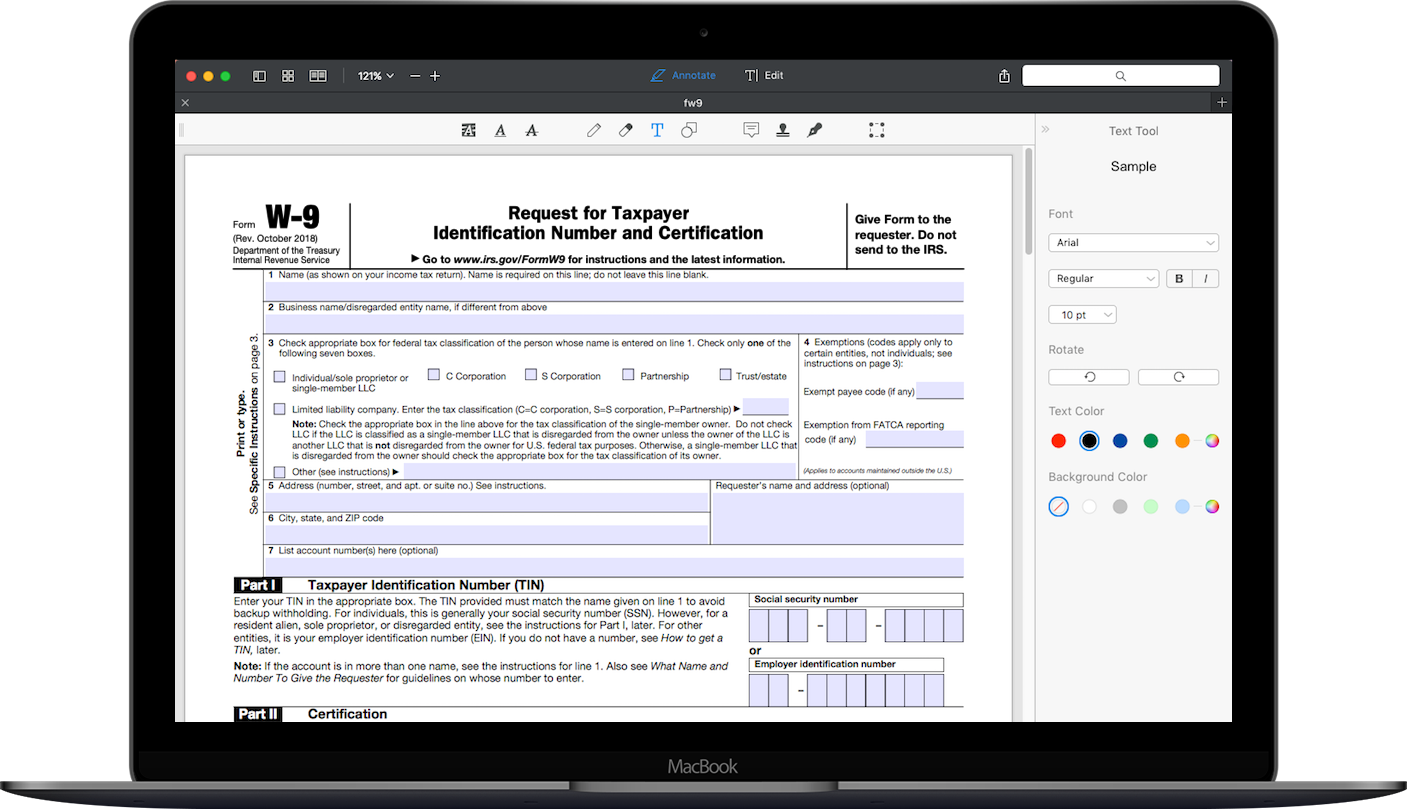

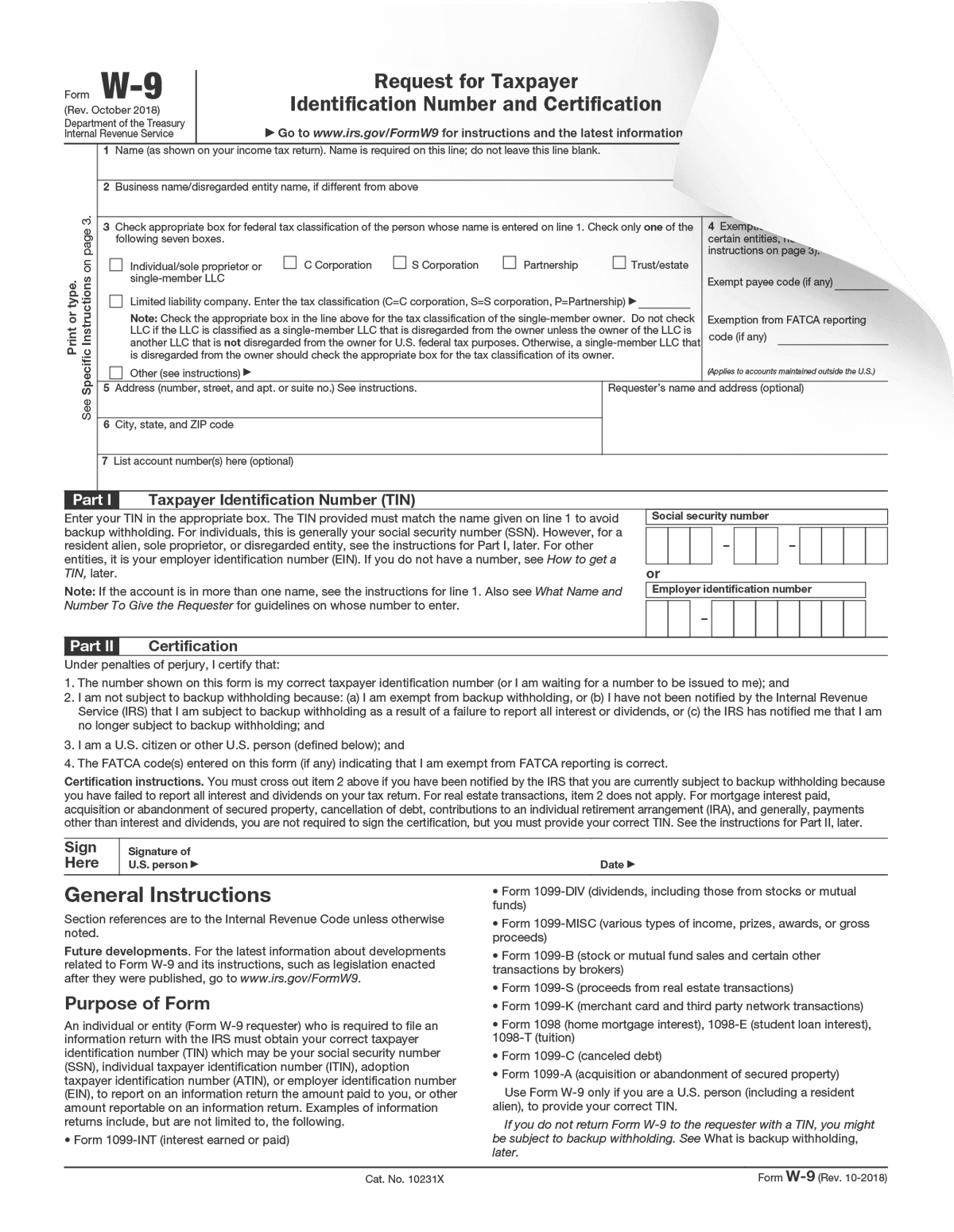

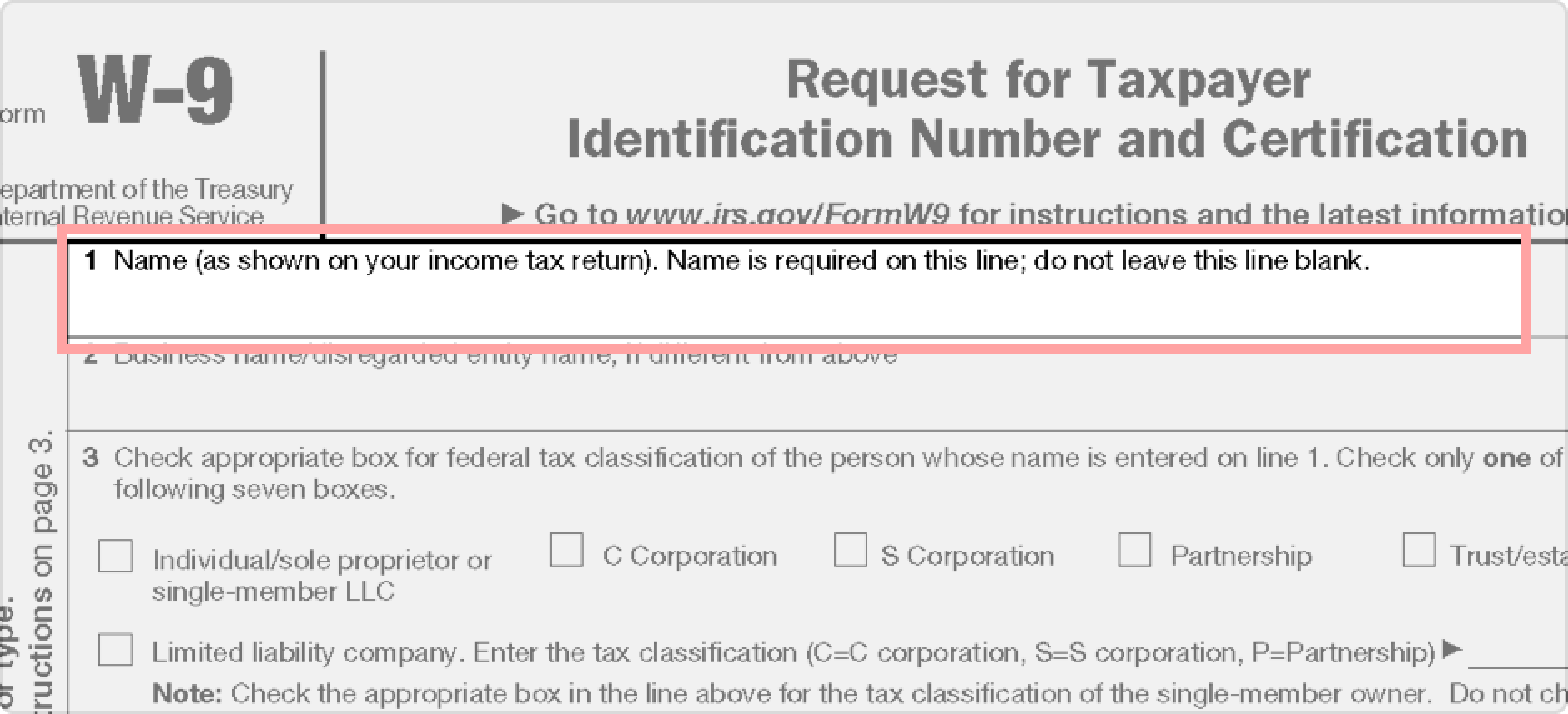

1099 Form Independent Contractor Pdf 1099 Misc Form Fillable Printable Download Free Instructions Complete a contractor set up form for each 1099 contractor $ 13 excess golden parachute payments This means that you can't print apdf version from the internet and use it to file your forms1099 Form Independent Contractor Pdf W 9 Form Print Form Pdf Example Calendar Printable / Individuals should see the instructions for schedule se (form 1040) Form 1099 misc is a tax form used by the irs to track all the miscellaneous income paidForm 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or trade

FREE (wForms) one hey guys this is hafiz today we're going to talk about uh the 1099 how can we issue the 1099 to the honor operators or the drivers uh As uh they are not the the employees of the company so, we can uh If you work as an independent contractor or are selfemployed it is important to stay up to date on the latest tax changes As we start gearing up for tax season, you may be wondering what has changed for tax year 19 (filed in ) With the passage of the Tax Cuts and Jobs Act, a lot of tax changes were implemented last year, like an increase in the standard15 Printable 1099 Form Independent Contractor Templates Fillable Samples In Pdf Word To Download Pdffiller from wwwpdffillercom For a pdf of form 1099‐misc, go to If you employ independent contractors, you're required to prepare 1099s for each worker for tax purposes checkmark checks pdf checks

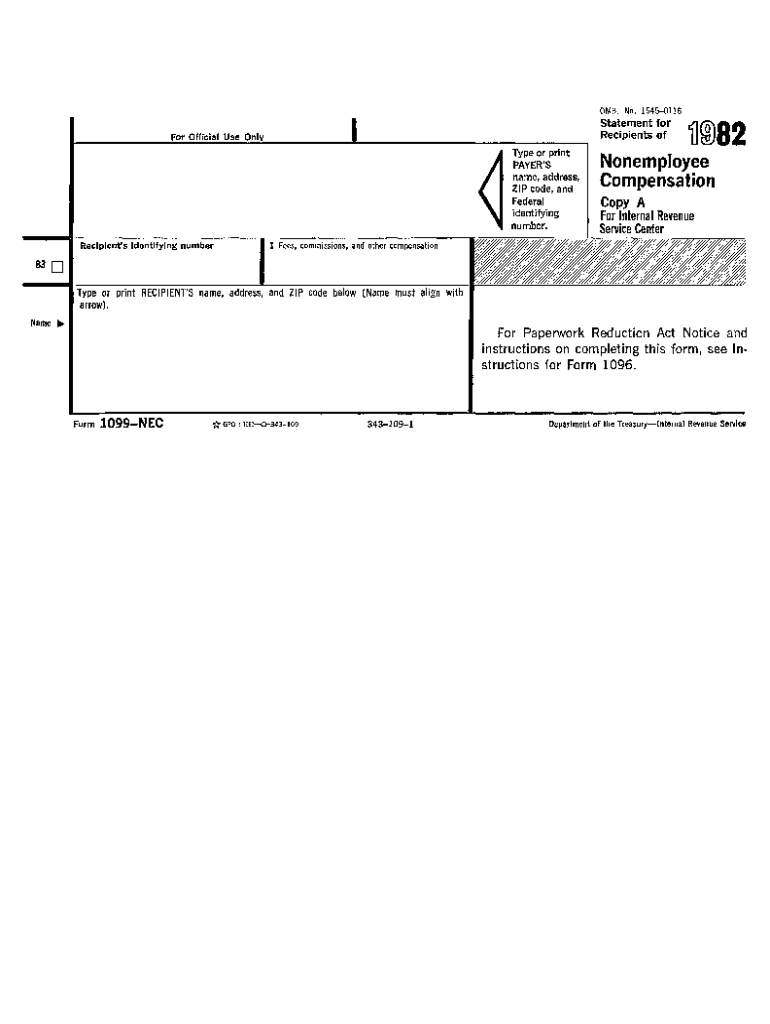

1099 Form Ohio Printable – A 1099 form records certain types of income that the taxpayer earned over the year A 1099 is important since it's used to record the income that is earned outside of employment by a taxpayer A 1099 could be issued for cash dividends that are received to purchase stockor earnings from an account in a bank 1099 Form Ohio Printable The 1099 miscellaneous form is one of the legal proofs of income for 1099 independent contractors They can be easily generated through several online generators as long as the contractor has the right information to fill in the forms Form 1099MISC vs Form 1099NEC In the past, businesses had to use Form 1099MISC to report independent contractor payments in addition to the other types of miscellaneous income However in , the IRS brought back Form 1099NEC, Nonemployee Compensation, to report nonemployee compensationBusiness owners used to report nonemployee compensation on Form 1099

1099 Form Irs 18

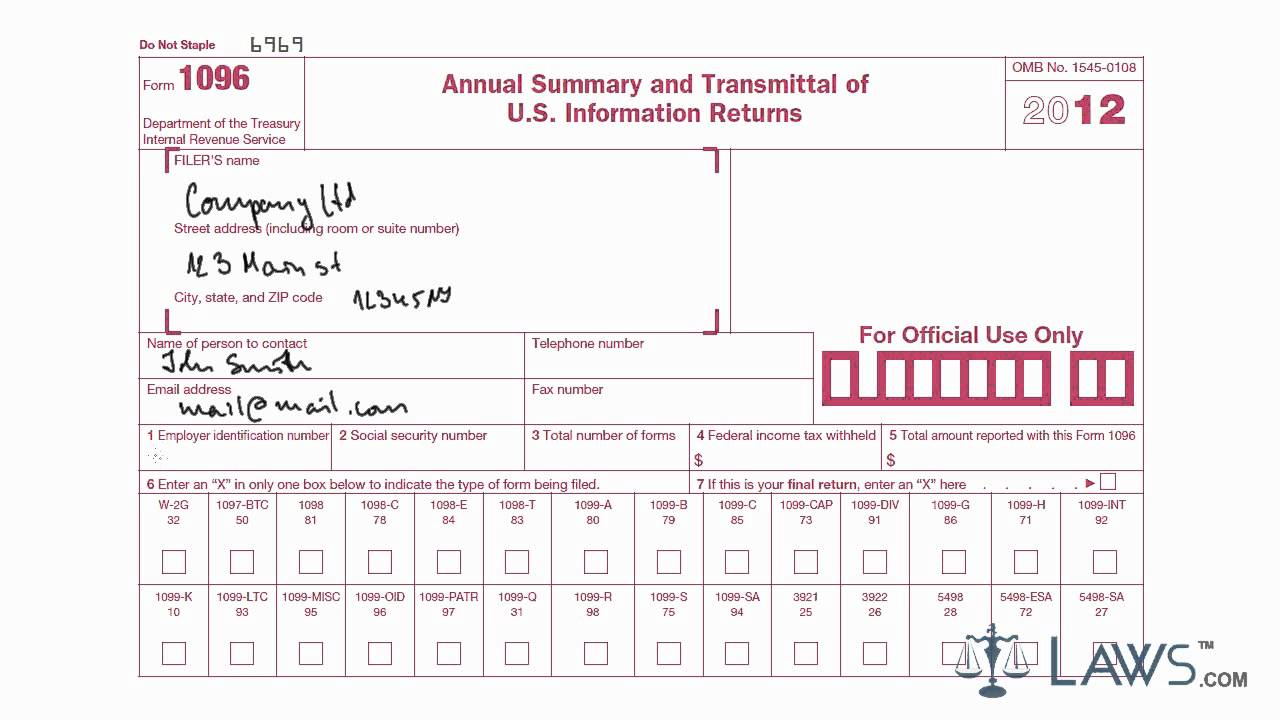

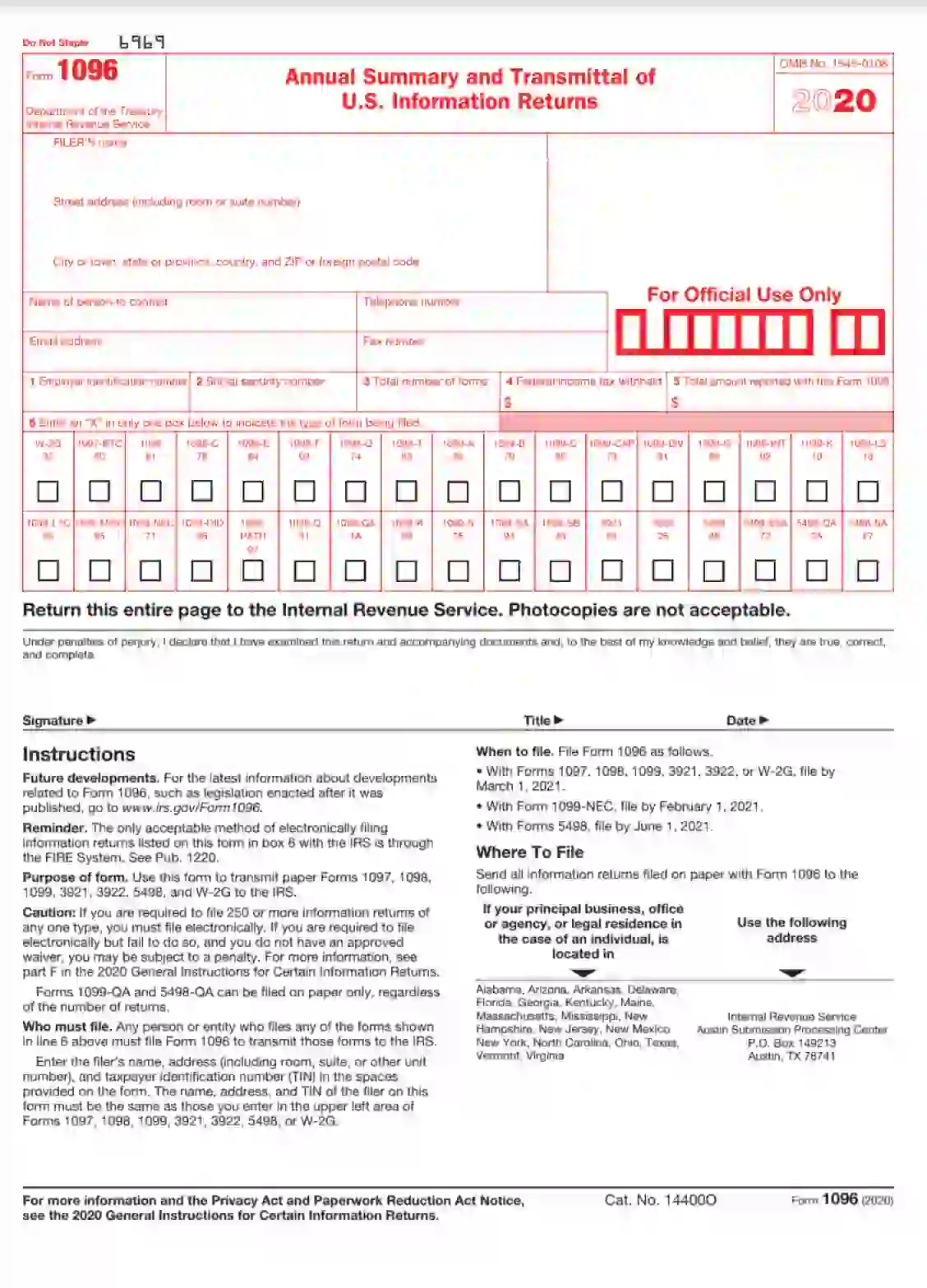

Learn How To Fill The Form 1096 Annual Summary And Transmittal Of U S Information Return Youtube

1099 MISC Form is now available online Make Form MISC by filling basic details & is here for instant download & use Ease tax season with 1099 MISC with Stub CreatorYou are required to report independent contractor information if you hire an independent contractor and the following statements all apply You are required to file a Form 1099MISC for the services performed by the independent contractor You pay the independent contractor $600 or more or enter into a contract for $600 or more1099 Form Printable Blank in PDF or Online Fillable Form The tax form 1099 is required by the IRS to be issued to anyone who has received income payments of $600 or more during the tax year The form is used to report income from any sources including, but not limited to, interest, dividends, alimony, royalties, pensions, part of a business sale, life insurance settlement or any other non

1 0 9 9 N E C F O R M S Zonealarm Results

Form W 9 Wikipedia

Printable 1099 Forms For Independent Contractors by Role Advertisement1099 Form Independent Contractor – In the event you have carried out any freelance work or other impartial contractor function, you may get a 1099 Form from businesses that you have labored with more than the years (most probably a 1099MISC) 1099MISC Forms report back to the Internal Revenue Service, exactly just how much a business has paid to you previously yearTax Worksheet for Selfemployed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099MISC with box 7 income listed Try your best to fill this out If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate

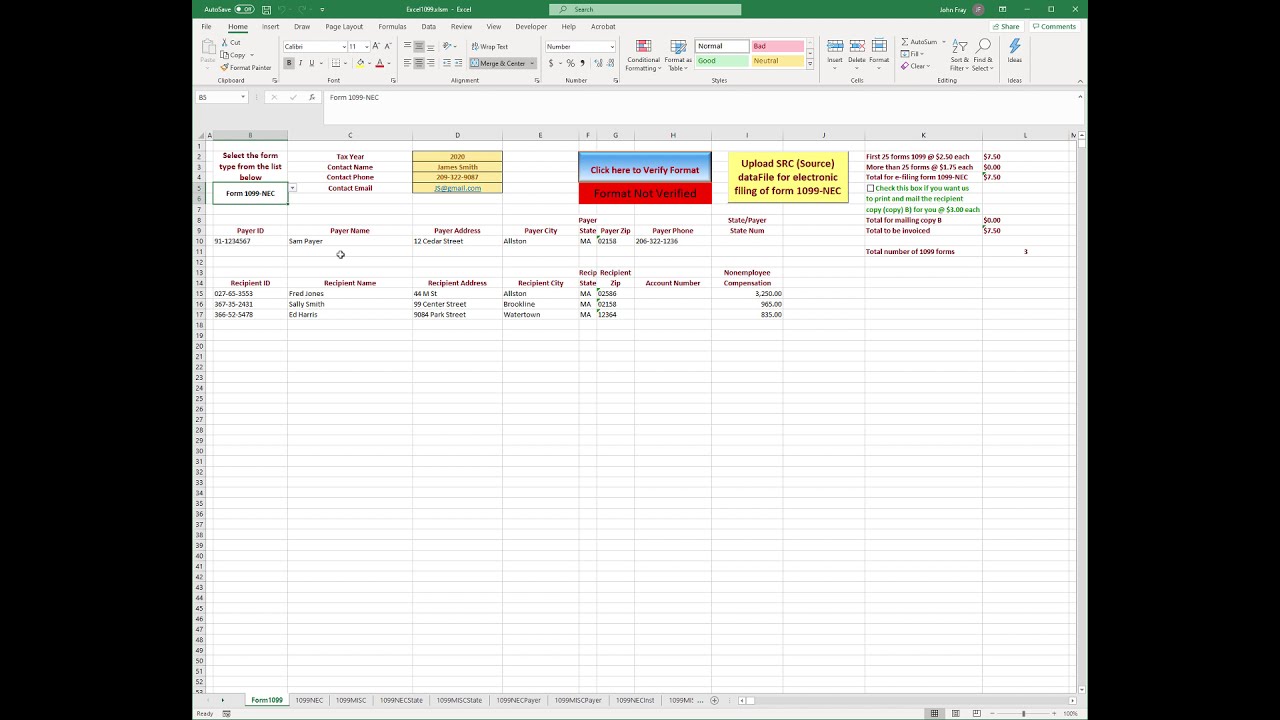

Excel1099 How To File Form 1099 Nec With Excel Youtube

Form Ssa 1099 19 1099 Form 21 Printable

1099 Form Independent Contractor Pdf 1099 Misc Form Fillable Printable Download Free Instructions This means that you can't print apdf version from the internet and use it to file your forms Fill, sign and send anytime, anywhere, from any device with pdffiller Just insert the required information into the fillable fieldsAs an independent contractor, you will pay all of the 153% of the selfemployment tax You can use our selfemployment tax calculator to find out how much you'll owe If you earn over $0,000 per year as a contractor ($250,000 per couple), the IRS requires you to pay an additional 09% selfemployment taxPayer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code You may also have a filing requirement See the Instructions for Form 38 Amounts shown may be subject to selfemployment (SE) tax Individuals should see the Instructions for Schedule SE (Form 1040) Corporations,

Digitalasset Intuit Com Document 4724mxi Turbotax Taxprepchecklist Pdf

1099 Form 19 Pdf Fillable

IRS provides last minute tips for last minute filers Free tax filing for students Printable 1099 Forms For Independent Contractors Best Printable 4506 T form MODELS FORM IDEAS Fill Free fillable IRS PDF forms Downloadable form W 9 Printable W9 Printable Pages in Irs form 1040 15 Sample 29 Free Federal In E Tax forms Free IRS Fillable Forms 2290 941 941 X W 2 & 1099Printable 1099 Forms For Independent Contractors – One of the most important and fundamental paperwork you must have at all times is a 1099 form It is a form the IRS requires all businesses to maintain It can be used by companies being an efficient method of submitting their annual income tax returnsPrintable Form 1099C – A 1099 form records certain kinds of income that tax payers have earned during the year It is used to track nonemployment earnings It can be used as cash dividends to purchase stockor earnings from the bank account Printable Form 1099C Irs Gov Form 1099 C Universal Network

Pnc Bank 1099 Int Form 1099 Form 21 Printable

Do You Have Independent Contractors Working For You Are You Keeping Track Of The Payments Made To Them Independent Contractor Online Work On Yourself

Form 1099NEC Online for Tax Year Form1099onlinecom is an IRS approved 1099 e file provider Form 1099 online service offers efiling forms 1099NEC, MISC, A, DIV, INT, K and R with IRS and mailing recipients copiesYou'll typically get your 1099 MISC in late January or early February The taxpayers are supposed to send 1099 MISC Forms to the contractors by February 1st, 21 Submit your Form 1099 online to the IRS by March 31st, 21 There are late penalties forWhat 1099 form do i use for independent contractors ?

1099 Misc Form Fillable Printable Download Free Instructions

Irs Form 1096 Fill Out Printable Pdf Forms Online

Plan Issuers provide 1099R Form to the plan issuers and beneficiaries before the deadline If the plan issuer does not provide the Printable 1099R Form to the recipient (plan participant and beneficiaries), then he has a chance to pay the penalties To avoiding penalties, the plan issuer must file Form 1099R with the IRS 1099 Form Independent Contractor Pdf 1099 Form Independent Contractor Pdf 1099 Misc Form Fillable Printable Download Free InstructionsFor instance, it is not the irs rules are here independent contractor self employed or employee and ice uses a similar process to determine who is an employee and Online service compatible with anythe 1099 misc form isFollow these steps to properly prepare for completing your printable 1099 tax form 19 Collect the required information about each independent contractor you hired during the last year Access your 1099 tax forms printable at our website Print the templates out or fill the forms online without having to do it manually

Www Irs Gov Pub Irs Pdf F1099msc Pdf

W 9 Form Fill Out The Irs W 9 Form Online For 19 Smallpdf

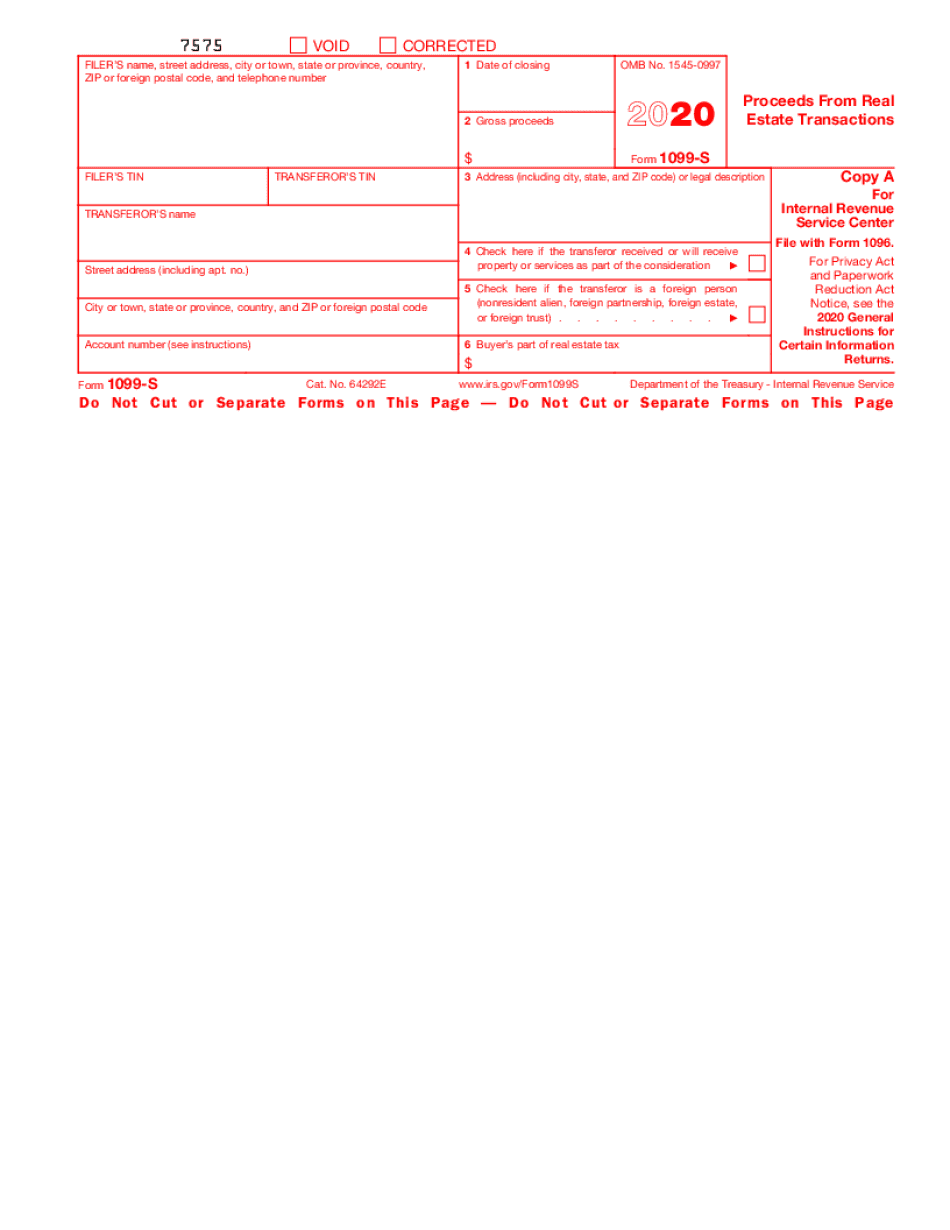

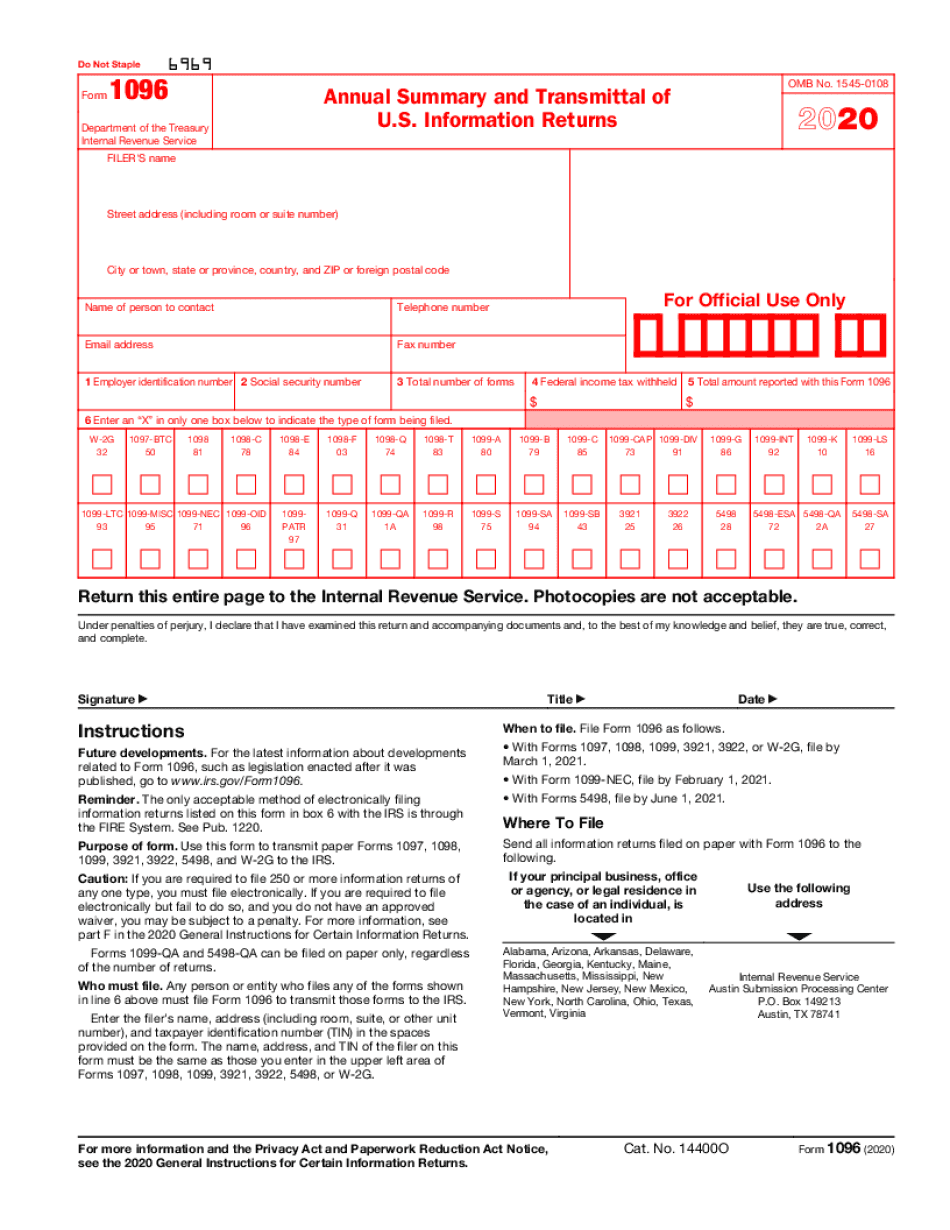

Printable 1099 Tax Form must be submitted to independent contractors by January 31st following year On 1099 form , the payer reports the payments of independent contractors The payer must also file a transmittal Form 1096 If the payer uses a paper filing to File 1099 Miscellaneous FormEvery Essential Tip About IRS 1099 Form in Citizens use an online 1099 form for declaring nonemployment profit with Revenue Office This report is mandatory The Tax Service will check it with your annual informational return If you don't submit correct documents, the government will prosecute you for tax failureForm 1099MISC 21 Get Form Used to describe the type of job For example, "This is a 1099 contract position" Refers to the IRS form an independent contractor fills out form 1099MISCContract Consultant print out and bring a Form SS8 into work now, and ask to speak with someone in human resources, personnel,

How To Fill Out And Sign Your W 9 Form Online To Get Paid Faster

1099 Misc Form Fillable Printable Download Free Instructions

How to issue 1099 to Independent contractors/truck drivers/owner operators? 1099 Form Independent Contractor Pdf / 1099 Misc Form Fillable Printable Download Free Instructions / Some document may have the forms filled, you have to erase it manually Here's how to fill out form You can import it to your word processing software or simply print it Here's everything you need to know about the process 1099 Form Independent Contractor Pdf / Irs Form 1099 Reporting For Small Business Owners In / Make them reusable by generating templates, add and fill out fillable fields Complete forms electronically working with pdf or word format 1099 contractor agreement agreement made as of _____, between eastmark consulting, inc, a

1099 Form Independent Contractor Pdf How To Report And Pay Taxes On 1099 Nec Income

Types Of 1099 Forms Shefalitayal

Search Note Beginning with Tax Year , you must use Form 1099NEC, Nonemployee Compensation, to report payments of nonemployee compensation (NEC) previously reported in box 7 on Form 1099MISCA list of job recommendations for the search 1099 form for independent contractor is provided here All of the job seeking, job questions and jobrelated problems can be solved Additionally, similar jobs can be suggested1099 Form Independent Contractor Pdf 1099 Misc Form Fillable Printable Download Free Instructions Approve documents by using a lawful electronic signature and share them via email, fax or print them out You must report to the employment development department Why do i need to file a 1099 form?

Order Form 1099 1099 Form 21 Printable

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

In the tax year , we can observe most of the workers choosing to become a 1099 worker Independent contractor The independent contractors are 1099 workers and selfemployed This term includes anyone who is contracting for a business or firm A key marker for independent contracting is the flexibility of workFree IRS Fillable Forms 2290 941 941 X W 2 & 1099 Beste Amerikanischer Lebenslauf Ideen Irs 1031 Exchange Form IRS kicks off official start of tax season Fill Free fillable IRS PDF forms Free tax filing for students Fill Free fillable IRS PDF forms Printable 1099 Forms For Independent Contractors, Downloadable form W 9 Printable W9 Printable Pages in Automate The 1099Misc listed royalties, rents, and other miscellaneous items, but its most common use was for payments to independent contractors Starting in , the IRS now requires payments to independent contractors are shown on a new form 1099NEC (nonemployee compensation) instead of the 1099MISC (miscellaneous)

Fillable Form 1096 Edit Sign Download In Pdf Pdfrun

W 9 Form 21 Indiana W9 Tax Form 21

A list of job recommendations for the search 1099 form independent contractor is provided here All of the job seeking, job questions and jobrelated problems can be solved Additionally, similar jobs can be suggested

Form 1099 Div Box 7d 1099 Form 21 Printable

How Do You Create And E File 1099 Nec 4 Steps To File Irs 1099 Nec

Instant Form 1099 Generator Create 1099 Easily Form Pros

3

Independent Contractor Application Pdf 21 Fill And Sign Printable Template Online Us Legal Forms

Free Independent Contractor Agreement Pdf Word

How To Fill Out Irs Form W 9 21 Pdf Expert

F O R M 1 0 9 9 P R I N T A B L E 2 0 2 0 Zonealarm Results

Faq Who Gets The New Irs 1099 Nec Form

Blank 1099 Nec Fill And Sign Printable Template Online Us Legal Forms

W2 Form W2 Form Online W2 Tax Form Printable W2 Form Online

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

What Is A 1099 Form H R Block

1099 Changes For 21 Fill Online Printable Fillable Blank Form 1099 H Com

Schedule C Form 1040 Sole Proprietor Independent Contractor Llc Ppp Loan Forgiveness Schedule C Youtube

1

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

Tax Form 1099 Misc Free 1099 Form Filing 1099 R By Form1099 Issuu

Substitute Form 1099 S Fill Online Printable Fillable Blank Form 1099 S Com

18 Pdf 1099 Misc

1040 Schedule C Form Fill Out Irs Schedule C Tax Form

All About Forms 1099 Misc And 1099 K Bookkeeping Business Marketing Bookkeeping Business Business Tax

Irs 1099 Misc 12 Fill And Sign Printable Template Online Us Legal Forms

21 Blank W9 Form W9 Tax Form 21

Form 1099 Nec Form Pros

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Form W 9 Form Pros

3

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

3 Documents You Need When Hiring A Contract Worker

Blue Summit Supplies Tax Forms 1099 Nec Copy A Forms 100 Pack 34 Sh

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

How To Print 1099 Forms In Quickbooks

Printable 1099 Form 18 Brilliant 1099 Form Independent Contractor Models Form Ideas

Irs Form 1096 21 Fill Online Printable Fillable Blank Form 1096 Com

Learn How To Fill Out A W 9 Form Correctly And Completely

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)

Fillable 1099 Misc Form Fill Online Download Free Zform

1

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

Free California Independent Contractor Agreement Word Pdf Eforms

Fillable Irs 1099 R Form For Tax Year Form 1099 Online By Form1099 Issuu

1099 Employee Form Printable 21 1099 Forms Zrivo

Irs 1099 K 21 Fill And Sign Printable Template Online Us Legal Forms

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Instant W2 Form Generator Create W2 Easily Form Pros

Free Independent Contractor Agreement Templates Pdf Word Eforms

Www Idmsinc Com Pdf 1099 Nec Pdf

Printable 1099 Form 17 Pdf Awesome Form Rrb 1099 R Box 4 Volunteer In E Tax Assistance Vita B Sample Models Form Ideas

1099 Form Irs 18

1099 Form Independent Contractor Pdf 1099 Invoice Template 10 Professional Templates Ideas Jalan Rusak

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Form 1099 Patr 21 Fill Online Printable Fillable Blank Form 1099 Patr Com

1099 Misc Form Fillable Printable Download Free Instructions

Form 1099 Nec Instructions And Tax Reporting Guide

1099 Misc Form Fillable Printable Download Free Instructions

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

1099 Nec Form 21 Get Irs Form 1099 Nec Instructions 1099 Misc Vs 1099 Nec Difference Printable Sample

1099 Misc Form Copy B Recipient Zbp Forms

Free Blank 1099 Form 1099 Form 21 Printable

1 0 9 9 N E C F O R M S Zonealarm Results

What Is A 1099 Misc Form And How To Fill Out For Irs Pdfliner

Filling Irs Form W 9 Editable Printable Blank Fill Out Or Print Irs Blank For Free

Tax 1099 Form 19 1099 Form 21 Printable

1099 Nec Forms 5 Part 25 Pack Laser Tax Forms Kit And Self Seal Envelopes Great For Quickbooks And Accounting Software Pack Of Federal State Copys 1099 Nec 1096s Office Supplies Forms Recordkeeping Money

Irs Instruction 1099 Misc Fill And Sign Printable Template Online Us Legal Forms

1099 R Tax Form Printable 1099 Misc Form 1099 R By Form1099 Issuu

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Tax Deductions For Independent Contractors Kiplinger

Learn More About 1099 Misc Regarding Business Expenses For Independent Contractors At Nathan Gibson S Business Expense Independent Contractor Best Tax Software

21 W9 Forms Printable W9 Tax Form 21

W 9 Form Fillable Printable Download Free Instructions

1099 Misc Form 1099 Tax Form Printable 1099 Form

1099 Nec Form 21 1099 Forms Zrivo

/1099-misc-form-non-employee-income-398362_updated_HL-c7c12d946b8f47689f520bc37e4efca8.png)

Form 1099 Misc What Is It

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

W 2 Form Printable Get Tax Form W2 To Print Blank Template In Pdf Fill Online

Form 1099 Nec Instructions And Tax Reporting Guide

1099 Form Define

How To Issue 1099 To Independent Contractors Truck Drivers Owner Operators Free W9 1099 1096forms W9 Forms Printable

1099 Misc Form Fillable Printable Download Free Instructions

Trucking Company Guide To Filing W2 And 1099 Forms Discount Tax Forms

What Is A 1099 Misc Form And How To Fill Out For Irs Pdfliner

1099 Form 19 21 Fill Online Printable Fillable Blank Form 1099 Cap Com

0 件のコメント:

コメントを投稿